It's not about timing the market, it's about time in the market.

I have a few homebuyers who are very concerned about buying right now.

The group most deterred by the recent mortgage interest rate hikes is Millennials. They are daunted by the headlines in their Instagram feed touting doom and gloom "housing market crash" and "interest rates double" etc.

Those Baby Boomers though...they keep on truckin'. You know why? Because this ain't nothing considering the last forty years of mortgage interest rate ups and downs, recessions, market crashes, and more - oh my! They take this hit like a notch on their belt strap and keep on truckin'. They scoff at 6.4% while whispering under their breath that this latest generation is soft, a bunch of whiners, and then hearken back to 1981 when mortgage interest rates were as high as 18.45%. Then was a time when we had something to whine about.

According to the National Association of Realtors® Baby Boomers have surpassed Millennials as the largest generation of home buyers making up 39% of the home buying market in 2023.

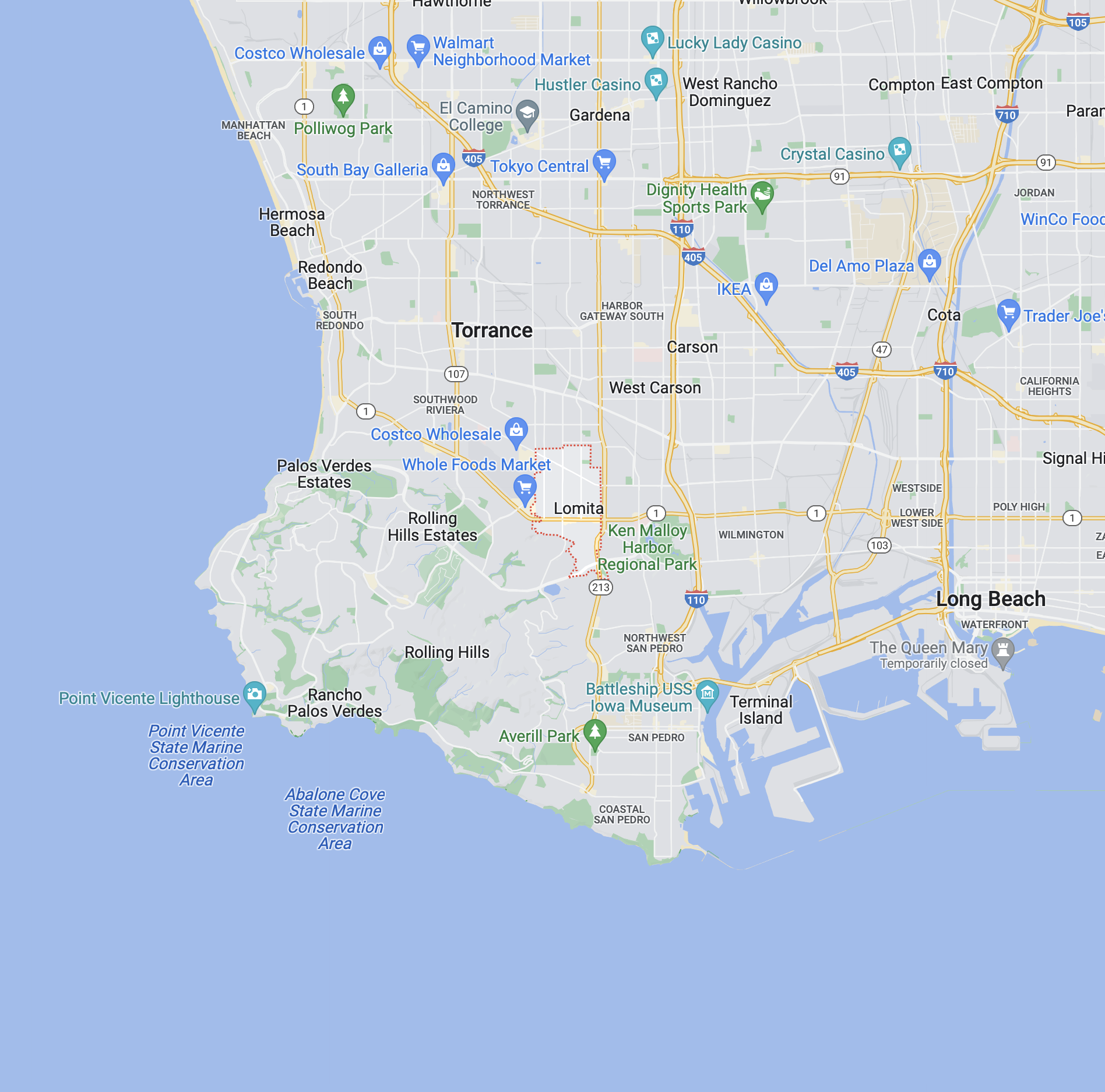

To all you fearful potential homebuyers, Los Angeles County has not seen a significant dip in home values. Agents in my office are still congratulating their buyers for beating out the other offers and homes are still going over asking price. And if anything, the mortgage interest rate increases have stabilized the market after years of unsubstantiated market gains. Between October 2021 and June 2022, the market was nuts. I still scratch my head about the correlation between the pandemic and the housing market and stock market simultaneously going bananas. It was time for a correction.

Look, real estate is still the best investment for your money. Yes financial portfolio diversity is important, so keep those mutual funds and that financial advisor on payroll, but learn from the Baby Boomers. This is a blip in economic history. Real estate will continue to appreciate simply because it's a brick and mortar asset (one of the few) and a necessity. Every human needs a home.

Don't be deterred by social media doom and gloom headline, one liner, click-bait, malarkey (shout out to the Baby Boomers.) Educate yourself and find out the real cost to buy a home. Crunch the numbers with a lender then make an educated decision about the possibility of buying a home. You may be surprised.

Let me ask you this.....do you want to buy in a hot market, competing with your hard earned dollars with every Tom, Dick and Suzie Q? In a hot market you have no leverage and your chances of getting your offer accepted could be 1 in 25 - your offer will need to be better than those 25 other offers? Are you tracking?

OR would you rather get in during a market when your odds are 1 in 4. Think about the difference in the offer you would need to make if you're competing with 4 offers versus 25 offers. Your interest rate means little when you are overpaying. And when those interest rates go back down, refinance.

Are the Boomers right?