Here’s the thing…

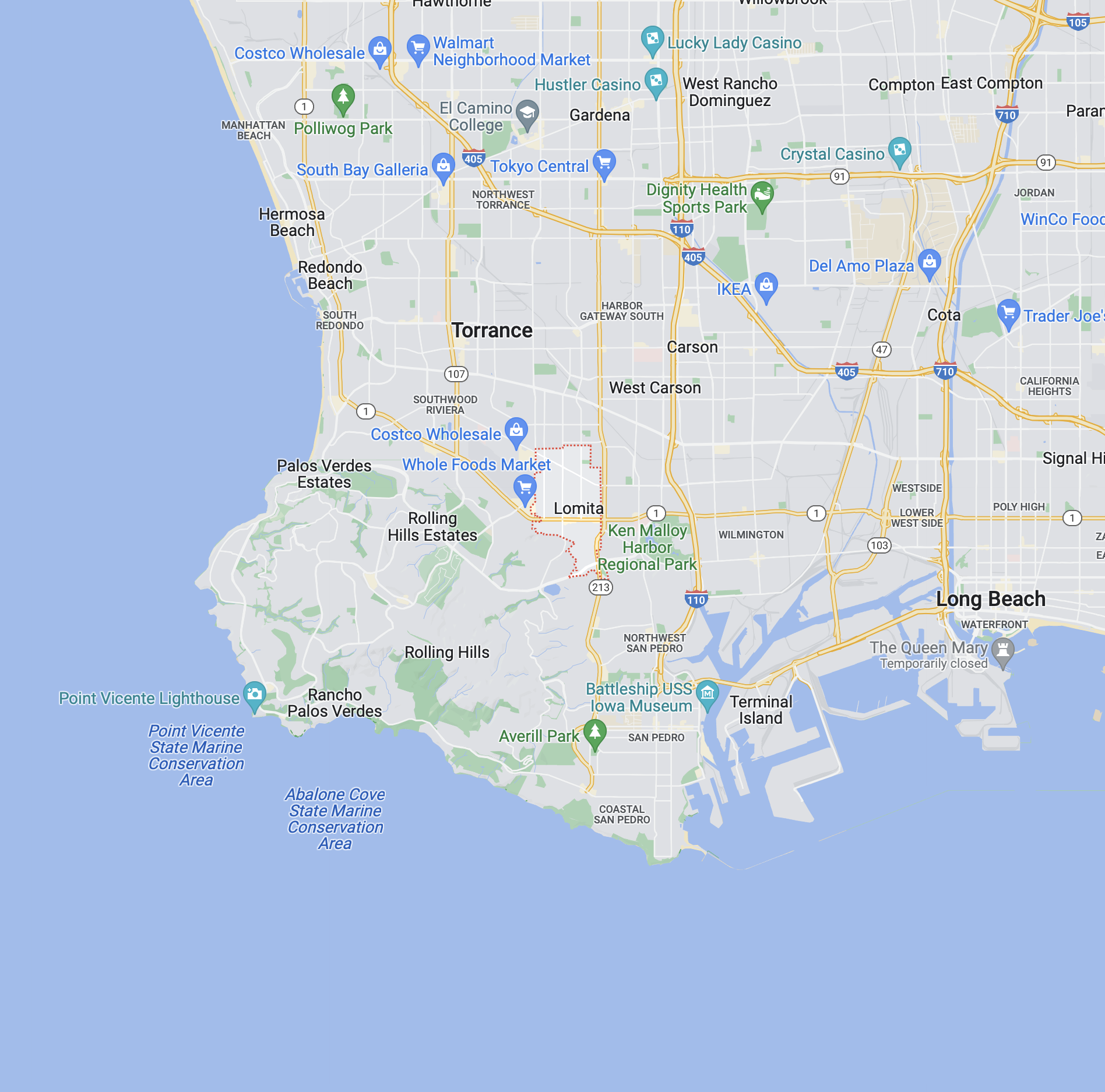

Lomita is a small town. 1.9 by 1.9 miles nestled in the South Bay of Los Angeles County. No one knows where Lomita is and if they do, they they underestimate what it’s like to live here. And that’s good for Lomita!

It is one of the best kept secrets in Los Angeles. If you like waking up to the sound of birds, a rooster and the distant murmurs of a major city, with an ocean breeze, then Lomita is the place for you.

Fifteen minutes to the beach, thirty five minutes to LAX airport, five minutes to Whole Foods and Trader Joes. You like to go for runs in nature? Then drive 8 minutes to the horse trails in Rolling Hills Estates where you will see wild peacocks and every other house has a horse stable, chickens, goats and the like. Hiking? Head up the hill on Crenshaw to Portuguese Bend with 180 views of the Pacific out to Catalina. You like to golf? There are seven golf courses or resorts within 10 miles of Lomita. You want to raise a pot bellied pig? West Lomita is zoned A-1 for residential agriculture. You are looking for a local watering hole? Lomita has not one, but two breweries - Burnin Daylight and Project Barley and the Lomita Alehouse is a good place for a local bar. Are you looking for one of the best dirty chai lattes this side of the 405? Corridor Flow has excellent coffee, food and wifi. Are you looking for top level dining? You might not find it in Lomita proper but drive ten minutes to Hollywood Riviera and hit up Rex, Bettolino or Gabi James.

Now let’s talk real estate. There’s a little something for everyone. Whether your budget is 200k or 1,200k you will find something in Lomita.

Yes, there are Mobile Home Parks in Lomita, but this is not your second cousin twice removed’s Mobile Park. This is So-Cal tiny house living. It’s all the rage! Just don’t forget to add in the land lease when you are doing the math on a $200k mortgage - check with your lender on loans for manufactured homes.

Now let’s talk about this A-1 section of Lomita where your neighbor will leave fresh chicken eggs on your door step in exchange for lemons from your tree. You may see the woman down the street walking her horse. Odds are you will be living on a cul-de-sac and have a white picket fence. If you want dirt and a garden, this is the best deal in the South Bay. FYI you are in the flight path of Zamperini municipal airport in this section, but the planes are small and they take off on the west side of the airport away from Lomita.

Lomita Pines is a little gem that no one seems to realize exists. During my door knocking the other day a gentleman put it this way - in Lomita Pines, we live in Palos Verdes with Lomita property taxes. Lomita Pines sits up on the hill and isn’t connected to the rest of Lomita. You have to drive through Palos Verdes to get to Lomita Pines. The views in this section are the best in the South Bay- if you live on the north side of Via Madonna, you can see downtown LA, Long Beach, San Bernardino Mountains, Santa Monica Mountains, the Pacific and Palos Verdes hills. If you live in this section chances are you will be there for the rest of your life. Most of the residents have been there for 40+ years and they all know each other. It’s a close knit neighborhood.

Downtown Lomita has restaurants, shopping, City Hall, a library, and the Farmers Market. The streets are flat and the neighbors are friendly. Drop into the Lomita Feed Store which has been there for 102 years. A little piece of history for this old western agricultural gem that has now become a modern town. Check out City Hall’s black and white photos of what Lomita was then as compared to now.

Reach out if you are looking for a local Lomita expert. I’m happy to be your realtor!